How to Inflation-Proof Your Small Business

3 ways to generate revenue and profit so that your business thrives.

Inflation presents multiple headwinds for businesses: tightening product margins, wage pressures and rising runnings costs — from electricity to rent and insurances. To make matters worse, consumer spending is weakening in some sectors. It’s no surprise then to see some businesses struggling to survive.

But that doesn’t have to be your story… Your business can thrive, even amidst inflation.

The next 3 years could be your best years yet. It all comes down to what you’re focused on. Are you focused on the negatives in the economy? Or are you focused on significant and sustained growth in your business? What you focus on is what you receive.

There’s an old saying that smooth waters don’t make great sailors. It’s the storms that teach us how to handle the ropes and navigate through choppy waters. Right now we’re in one of those environments — all the more reason to get focused and strengthen your sails.

That said, what can you do today? Here are 3 simple ways to start generating more revenue and profit so that your business can survive and thrive in this season:

1. Get your team focused around clear economic objectives

People are the most important a business. They’re also the biggest overhead. That’s why it’s important for every person on your team to know exactly what they should be focused on each and every day. If you’re hired the right people, they want to contribute their best work. Often, though, the business owner has not set clear any objectives, and so people default to doing busy work instead of profitable work. Efficiency can be improved by setting clear objectives that are grounded in economic reality:

“In the next 12 months, we will achieve X, Y and Z — because <insert mission statement>”

When you set 3 clear economic objectives, it does the following:

Creates immense clarity — team members can see exactly how the company mission can and will be achieved.

Acts as a filter — to ensure everyone is doing activities that actually help achieve the company mission, instead of ‘busy work’.

Gives you a baseline to create milestones for, measure performance and celebrate progress.

Action Step: Instead of just talking about your mission statement, build a bridge to it with 3 economic objectives that everyone can contribute to. Communicate the objectives with your team each week in an all-staff meeting. Celebrate your progress along the way.

2. Clarify your message and double down on your marketing

Now is the time to double down on your marketing. But before you do, you need a clear marketing message that can cut through the noise and get customers attention. Customers are searching for solutions to their problems. The more you talk about your customers problems using clear and simple language, the more customers will listen and buy-in.

Story is the best tool known to man to hold attention and communicate complex messages. StoryBrand is a framework that helps you filter your marketing message through the timeless elements of story. If you haven’t read the book or taken the course already, now is the time to leverage StoryBrand.

Once you’ve got a clear message, you’ve got to get that message in-front of customers and stay top-of-mind for when they’re ready to buy. This is what a sales funnel does. A sales funnel guides customers through the 3 natural stages of a relationship towards a sale:

1) Awareness

2) Enlightenment

3) Commitment

Your (online) sales funnel should incorporate marketing assets including lead generators, landing pages and email marketing campaigns. When you have a good funnel that works alongside your sales activities, you can incorporate advertising to supercharge your results.

If you have not built a sales funnel with a Coach yet, now is the time to start. Most small businesses run ads on social media without first creating any sales funnel — that’s a huge waste of money!

Action Step: Clarify your marketing message using the StoryBrand framework and create an online sales funnel to help nurture and convert customers. Run advertising to your sales funnel to increase your leads and sales.

(You can take the StoryBrand course at BusinessMadeSimple.com for $275/year)

3. Prioritise your most profitable products

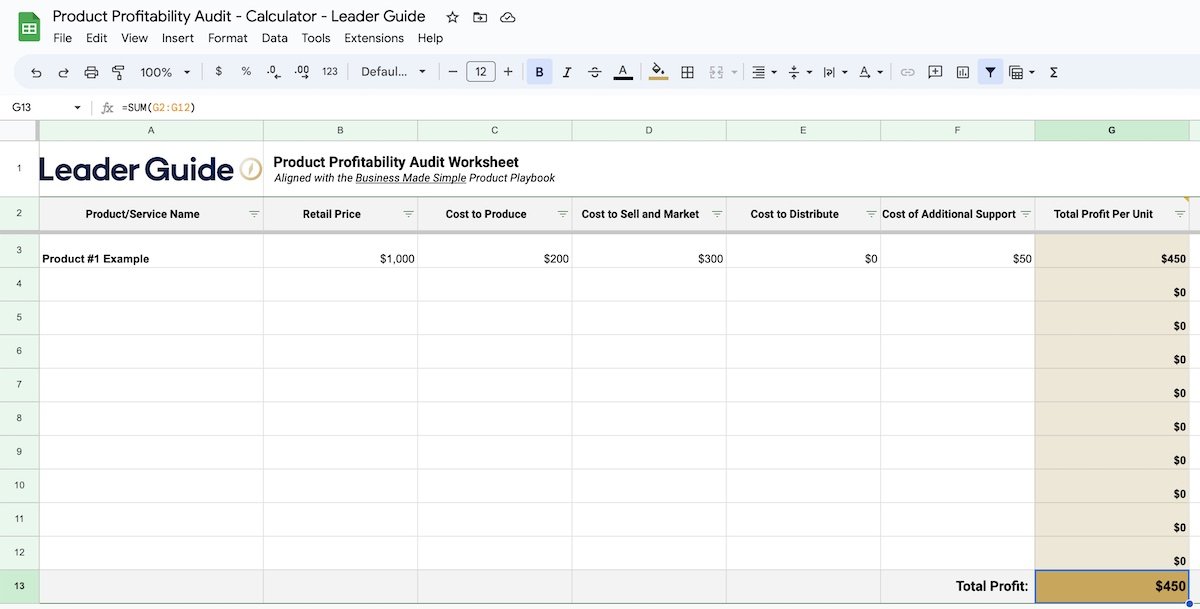

Marketing and sales will help you generate more revenue and profit, but there’s a third way: optimising your products. Most businesses have a list of products (including services) on offer — but have you ever stopped to find out where your income is really coming from? You might know which products bring in the most revenue, but are they actually profitable?

Assessing the profitability of your products will help you determine where your money is really coming from and and going.

Every time you add a product to your offering, there’s an opportunity cost. If your team is focused on servicing a product (or client) that generates little to no profit, then you don’t have time to be servicing a highly profitable product.

Here is a FREE template you can use to audit and rank your products by profitability, so that you can allocate your resources to the selling the right products:

Action Step: Audit your products using the template, discuss the results with your team and adjust your priorities. Work with a Coach to optimise your other products to that they too are highly profitable.

BONUS: Install a cash flow system to protect profit

Managing cash flow can be stressful, especially when you’re experiencing large fluctuations in revenue. Surveys show that cash flow is the #1 thing keeping business owners up at night grinding their teeth.

The need for cash never ends. As your business gets bigger, you need more cash on hand than ever to cover growing overheads and reinvestments.

Zig Ziglar once said, “Money isn’t everything... but it ranks right up there with oxygen.” He’s right, nothing kills a business faster than a lack of oxygen.

One way to help manage cash flow is to create a simple banking system to allocate money aside and get instant clarity on your cash flow reserves. Sure, you can run a Xero report, but most business owners only do that once a month or once a quarter — which is often too late when cash flow problems present themselves. You’re most likely looking at your bank account daily, so you may as well have a system that works within that habit.

At Leader Guide we Coach business owners around a simple system that incorporates 5 banks accounts: Operating Expenses, Tax/Payroll, GST, Profit, Owner Expense/Investment.

Once you’ve set up the 5 accounts and automated transactions between them, it brings a level of sanity and calmness back into your decision making and running of the business finances — because you know, within a glance, how much you have to operate with and how much profit your business is accumulating.

A great book that this system aligns with is Profit First by Mike Michalowicz. We’d encourage you to read that book if you’ve been struggling to realise profit in your business.

Action Step: Set up 5 business bank accounts and calculate how much money to automatically transfer to the different accounts on a monthly basis. Work with your Coach and Accountant to run reports and make adjustments.

Well, that’s it! 3 things (plus a bonus) that you can do to generate more revenue and profit in your business right now, and see you business thrive amidst inflation.

Work with a business Coach to gain focus and take action.

Note: This was written by Lachlan Nicolson in August 4, 2023. Things may have changed since.

Up next: How to Achieve Exponential Growth

Every month we take 5 lessons from a leading business book and email it to you

Want to get that mid-monthly email? If so, Subscribe FREE to the Leader Guide Community. + You’ll also get the chance to WIN a book!